XchangeRate Robot (XRR) Existing Cryptocurrency Trading

XchangeRate an intelligent algorithm or “robot” that helps investors navigate the complex cryptocurrency market and make expert decisions, all in one convenient platform. Data pipelines from plugins and APIs combine with unique, relevant metrics to detect market attitudes. Investors set buy/sell parameters and choose to make manual or automatic trades triggered by if/then conditions. Users are freed from having to make every decision and separately track trends and currencies. Instead, the XchangeRate robot makes intelligent decisions on its users behalf, enabling investors to trade popular currencies around the clock based on set criteria and interpretation of good data nalysis proprietary to XRR platform.

The first Augmented Intelligence platform SaaS App that brings intelligently analysed data to the trader using automation and decentralized strategy sharing.

Powerful Preset Filters: XchangeRate is a platform designed by traders for traders. Automated filter settings comes with a preset strategy that requires minimal efforts.

Cross Functional Strategy Approach: XchangeRate parses through the metric attributes of each coin on the exchange and loops through the strategy filter for entry signals and rates them on a scale of preference and fires a trigger through qualifying positions, loops the criteria using automation on entry and exits and in rounds and cycles.

Implementation Proofing: Adopting a strategy is one thing. Getting it into the market flow is another. XchangeRate provides tools to test strategies and filters with real market conditions and tests the strategy outcomes.

To expand XchangeRate.io’s vision and reach, we are launching a Token sale to issue XchangeRate tokens (XRR) on the Ethereum Blockchain. ERC20 XchangeRate tokens will be issued by smart-contract at the end of the Token sale (May 2018).

The XRR Team will work with major exchanges such as Yobit, EtherDelta, KuCoin, Huobi, OkEx, and Binance to list the XRR coin on their exchanges so that the XRR Coin can be easily bought and sold.

Since the Users of the XchangeRate Platform depend on the tools for their market engagement and trade activities, this concept creates a demand where there would always be a need to purchase XRR token from its holders.

Other currencies, while selling at lower prices than Bitcoin, have similarly experienced high growth and volatility. It should be noted that cryptocurrency remains vulnerable to outside influences. A recent study found that Bitcoin prices can affect other major cryptocurrencies, especially during periods of rapid price growth and falls. The study noted several factors that highlight cryptocurrency interconnectivity and potential volatility, including changes to regulation, the operational effectiveness or presence/absence of an exchange and technological failures brought about by application design or malicious computer hacking.

Cryptocurrency is here to stay. As its popularity and visibility increase, average income earners are becoming interested in investing. However, high prices and the unpredictability of the market can deter potential investors from entering the constantly fluctuating cryptocurrency trade. Without an in- depth understanding of the cryptocurrency market, potential entrants may feel hobbled in making decisions of either to buy or to sell, especially given the huge fiat losses they may experience if they execute a trade at the wrong time. Moreover, no investor is able to remain constantly informed on every nuance of a 24/7 global market with multiple, interdependent currencies.

The market needs an algorithmic tool not only to help users analyze the exchanges but relieve them from the responsibility of decision-making. In other words, the market needs a robot, who works for them.

+ Informational: accumulating information from the internet, collecting different types of information (news, analysis, research, etc.) useful for traders on one easy-to-read platform (ex. Hade platform) making it easy for users to sort, filter, and process in order to make informed decisions;

+ Providing trading signals and predicting the market move (ex. Fintab, CoinFi, Signals, Taylor, Trademindx, Savedroid, Fox trading, Dropil, etc) basing on automatically collected and analysed data or using the AI.

We will not review all the existing systems in detail, because all of them are leaving the decision making process to traders.

The XchangeRate Robot (XRR) on the contrary detects and makes decisions on buy/sell attitudes itself. Our ultimate pursuit is to become a universal platform where users of our tools can leverage on our unique metric to have an edge on exchanges. Our metric has the unique ability to predict price direction by evaluating patterns in data that are publicly available on the exchange using API. These data characteristics are available and applicable on several exchanges where other instruments are exchanged like stocks, gold, oil, forex and other derivatives.

XchangeRate is well on her pathway to being a central platform that trades these instruments using XRR tokens as the only currency used to communicate value among users and platform access

The XchangeRate Robot gathers data across multiple platforms for analysis using metrics for intelligent filters. These data have structures that give them an immense historical value that can be used for trend and forecasting. XRR implementation of these structures will allow for the archiving of these data assets in patterns that break specific user information away to store data, data sources, strategy and time in a way that can be used for valuable analysis. This will be an age long commitment XRR team will engage to leave these data as a contribution to analyzing markets – a valuable tool for research.

Decision Making

The XchangeRate Robot (XRR) is built upon a series of algorithms to detect and make decisions on buy/sell attitudes. The Relative Strength Index (RSI), is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100.

Traditionally, the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by finding divergences and failure swings. RSI can also be used to identify general trends.

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD called the "signal line" is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

Metrics

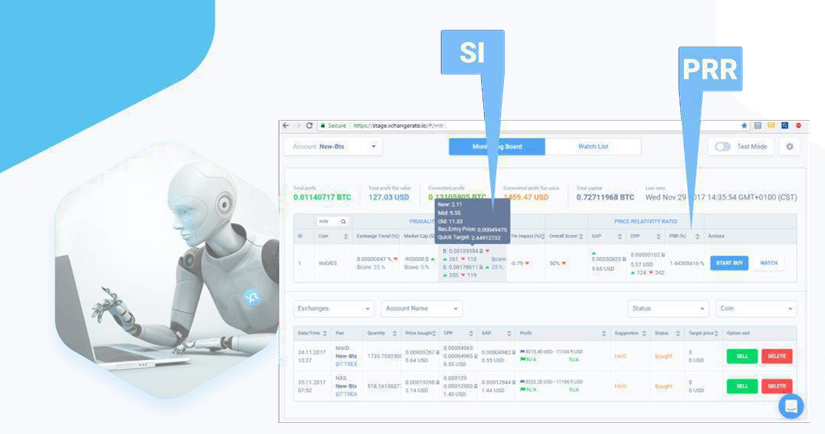

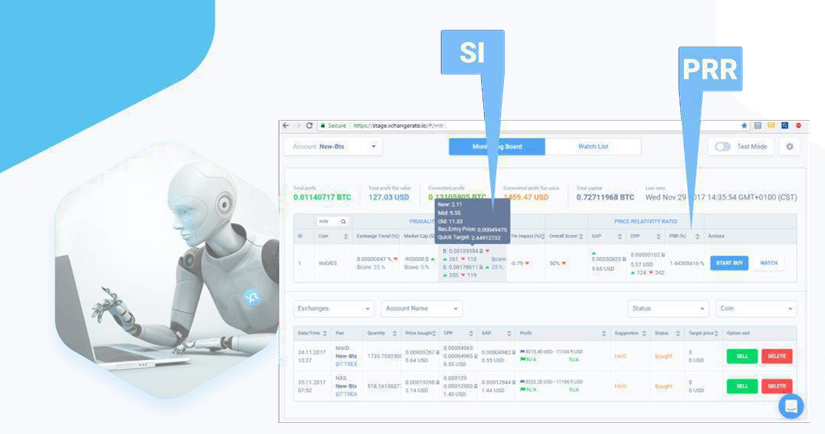

Price Relativity Ratio (PRR) is a ratio that compares the global price of a coin and the Ask/Bid on the exchange. The ratio bases its assumption on the fact that the price on the exchange tends to the global price. However, it would be safe to use some other indicators to strengthen the argument that the PRR provides.

The Suitability Index (SI) is the index that measures the average rate of coin traffic or demand on a coin on an exchange. It seeks to inform the trader if the demand is incremental or decremental. It helps the trader to make a buying decision based on how soon the trader would like to exit the trade.

The watch list, on the other hand, does not do the actual exchange transaction but uses the preset filter to alert the trader when a coin has reached the indicators specified by the user.

Whitepage: https://tokensale.xchangerate.io/en/whitepaper/en/

ANN: https://bitcointalk.org/index.php?topic=3110277

Facebook: https://www.facebook.com/xchangerate.io

Twitter: https://twitter.com/XchangeRate_io

Telegram: https://t.me/xchangerateICO

Author

Bitcointalk:https://bitcointalk.org/index.php?action=profile;u=1330327

The first Augmented Intelligence platform SaaS App that brings intelligently analysed data to the trader using automation and decentralized strategy sharing.

Powerful Preset Filters: XchangeRate is a platform designed by traders for traders. Automated filter settings comes with a preset strategy that requires minimal efforts.

Cross Functional Strategy Approach: XchangeRate parses through the metric attributes of each coin on the exchange and loops through the strategy filter for entry signals and rates them on a scale of preference and fires a trigger through qualifying positions, loops the criteria using automation on entry and exits and in rounds and cycles.

Implementation Proofing: Adopting a strategy is one thing. Getting it into the market flow is another. XchangeRate provides tools to test strategies and filters with real market conditions and tests the strategy outcomes.

XchangeRate token

To expand XchangeRate.io’s vision and reach, we are launching a Token sale to issue XchangeRate tokens (XRR) on the Ethereum Blockchain. ERC20 XchangeRate tokens will be issued by smart-contract at the end of the Token sale (May 2018).

Token name: XRR coinXRR Coin will be implemented as a utility token used to transact on the xchangerate.io in two major models. There is a subscription charge where users will make a minimum monthly payment to gain access to the platform. There is also a strategy rating marketplace where users can check the success rates of different strategies and the Token Costs (TC) the initiators have attached to them. Token Adopters can adopt these strategies at the TC while there is a platform fee for the transaction.

Token symbol: XRR

Token type: ERC20

Token role: Utility

Total supply: 250 000 000

Available forsale: 235 000 000

Public ICO dates: April 12, 2018 - May 9, 2018

Minimum purchase: 0,10 ETH or 0,01 BTC

Accepted payment methods: ETH, BTC

Token ICO price: 1 ETH = 10 000 XRR

Soft Cap: 2000 ETH or 200 BTC

Hard Cap: 16 000 ETH or 1 600 BTC

The XRR Team will work with major exchanges such as Yobit, EtherDelta, KuCoin, Huobi, OkEx, and Binance to list the XRR coin on their exchanges so that the XRR Coin can be easily bought and sold.

Since the Users of the XchangeRate Platform depend on the tools for their market engagement and trade activities, this concept creates a demand where there would always be a need to purchase XRR token from its holders.

Problem

Cryptocurrency is notoriously volatile and can provide barriers to entry, as evidenced by Bitcoin. The Bitcoin price index grew from $367 in January 2016 to over $4000 at the end of August 2017 and experienced explosive growth in Q4 of the same year1,5 but the market saw wild upward and downward swings in the short terms.Other currencies, while selling at lower prices than Bitcoin, have similarly experienced high growth and volatility. It should be noted that cryptocurrency remains vulnerable to outside influences. A recent study found that Bitcoin prices can affect other major cryptocurrencies, especially during periods of rapid price growth and falls. The study noted several factors that highlight cryptocurrency interconnectivity and potential volatility, including changes to regulation, the operational effectiveness or presence/absence of an exchange and technological failures brought about by application design or malicious computer hacking.

Cryptocurrency is here to stay. As its popularity and visibility increase, average income earners are becoming interested in investing. However, high prices and the unpredictability of the market can deter potential investors from entering the constantly fluctuating cryptocurrency trade. Without an in- depth understanding of the cryptocurrency market, potential entrants may feel hobbled in making decisions of either to buy or to sell, especially given the huge fiat losses they may experience if they execute a trade at the wrong time. Moreover, no investor is able to remain constantly informed on every nuance of a 24/7 global market with multiple, interdependent currencies.

The market needs an algorithmic tool not only to help users analyze the exchanges but relieve them from the responsibility of decision-making. In other words, the market needs a robot, who works for them.

Existing Cryptocurrency Trading Solutions

At the moment all trading solutions available on the market can be divided into the following groups:+ Informational: accumulating information from the internet, collecting different types of information (news, analysis, research, etc.) useful for traders on one easy-to-read platform (ex. Hade platform) making it easy for users to sort, filter, and process in order to make informed decisions;

+ Providing trading signals and predicting the market move (ex. Fintab, CoinFi, Signals, Taylor, Trademindx, Savedroid, Fox trading, Dropil, etc) basing on automatically collected and analysed data or using the AI.

We will not review all the existing systems in detail, because all of them are leaving the decision making process to traders.

The XchangeRate Robot (XRR) on the contrary detects and makes decisions on buy/sell attitudes itself. Our ultimate pursuit is to become a universal platform where users of our tools can leverage on our unique metric to have an edge on exchanges. Our metric has the unique ability to predict price direction by evaluating patterns in data that are publicly available on the exchange using API. These data characteristics are available and applicable on several exchanges where other instruments are exchanged like stocks, gold, oil, forex and other derivatives.

XchangeRate is well on her pathway to being a central platform that trades these instruments using XRR tokens as the only currency used to communicate value among users and platform access

Building the Robot

XchangeRate FoundationThe XchangeRate Robot gathers data across multiple platforms for analysis using metrics for intelligent filters. These data have structures that give them an immense historical value that can be used for trend and forecasting. XRR implementation of these structures will allow for the archiving of these data assets in patterns that break specific user information away to store data, data sources, strategy and time in a way that can be used for valuable analysis. This will be an age long commitment XRR team will engage to leave these data as a contribution to analyzing markets – a valuable tool for research.

Decision Making

The XchangeRate Robot (XRR) is built upon a series of algorithms to detect and make decisions on buy/sell attitudes. The Relative Strength Index (RSI), is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100.

Traditionally, the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by finding divergences and failure swings. RSI can also be used to identify general trends.

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD called the "signal line" is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

Metrics

Price Relativity Ratio (PRR) is a ratio that compares the global price of a coin and the Ask/Bid on the exchange. The ratio bases its assumption on the fact that the price on the exchange tends to the global price. However, it would be safe to use some other indicators to strengthen the argument that the PRR provides.

The Suitability Index (SI) is the index that measures the average rate of coin traffic or demand on a coin on an exchange. It seeks to inform the trader if the demand is incremental or decremental. It helps the trader to make a buying decision based on how soon the trader would like to exit the trade.

Application Methods

The XchangeRate robot has a console where the data read from over all the platforms is presented to the trader to help ease the decision making process. The trader can make informed choices based on the strength of the indices provided. This console is named Coin Monitoring Board (CMB). The CMB provides the RSI, MACD, PRR, FR and the SI very handy to the trader. However, the XchangeRate robot is designed as an automated tool to function as a smart buy and sell robot using these indicators as the elements used to filter coins on the exchange.

The watch list, on the other hand, does not do the actual exchange transaction but uses the preset filter to alert the trader when a coin has reached the indicators specified by the user.

Team

Roadmap

More Information

Website: https://tokensale.xchangerate.io/Whitepage: https://tokensale.xchangerate.io/en/whitepaper/en/

ANN: https://bitcointalk.org/index.php?topic=3110277

Facebook: https://www.facebook.com/xchangerate.io

Twitter: https://twitter.com/XchangeRate_io

Telegram: https://t.me/xchangerateICO

Author

Bitcointalk:https://bitcointalk.org/index.php?action=profile;u=1330327